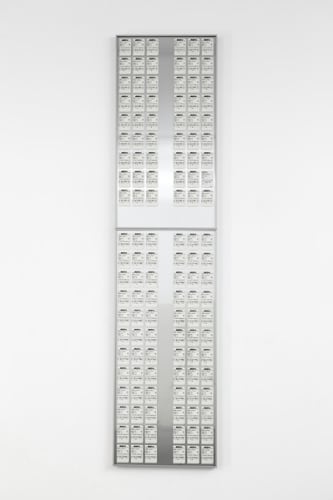

126 boarding passes, framed in two panels

Karmelo Bermejo ", 2012 126 boarding passes, framed in two panels The funds granted by the Spanish bank Santander to make an art work were used to speculate with Bankia shares. The capital gains were assigned to the purchase of all the seats of a scheduled flight from Europe to Africa, so that it flew empty. During the summer 2012, in the middle of the euro zone crisis, the Spanish state took control of the Spanish banking conglomerate Bankia, whose shares made its shareholders lose 90% of the money they had invested. In this context, the shares’ value varied strongly, raising up to 30% and then going down deeply during one day. This volatile scenario, caused by the Hedge Funds of the City of London operating the shares, went on for several days. It was then when the total amount of the funds granted by the Santander bank –through the Botín Foundation– was used to trade the shares, buying Bankia securities with a raising trend within the day and closing with benefits over its value the next day. The capital gains were assigned to purchase the seats of a scheduled flight in high season that took off, carrying no passengers, at 11:30pm on 24 August, from Barcelona to Tunis.